Three years on from the COVID crash, we show what the financial cost could have been from selling out of the share market in 2020.

You may have heard the saying that time in the market is better than trying to time the market.

But is that true? Should you sell when markets fall and then try and pick the best time to buy back in? Or is is better to stay invested, no matter what the market is doing?

Given we’ve just passed the three-year anniversary mark from the low point of the March 2020 COVID spurred widespread investor panic around the work and sent share markets into freefall.

The Australian share market, caught up in the maelstrom, dropped more than 35 per cent over about 20 trading sessions and reached its lowest level in more than a decade on 23 March 2020.

Now, just over three years later, and despite strong bouts of market volatility over the last 18 months or so due to economic, commercial, and geopolitical factors, the Australian share market is trading around 60 per cent higher than where it was in late March 2020.

But how does that gain translate into actual investment dollars, and what would the financial opportunity cost have been for someone who decided to get out of the share market completely back in March 2020?

Alternatively, what would have been the financial cost for someone selling their share market investment at that low point of the market and then buying back in six months later after global share markets had started rising again?

Case Study One

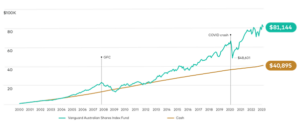

Let’s look at the first example, based on someone who initially invested $1,000 into the Vanguard Australian Shares Index Fund in January 2000.

This fund invests across the top 300 companies listed on the Australian Securities Exchange (ASX) and uses the S&P/ASX 300 index as its benchmark.

In addition to their starting investment, the investor made regular contributions into the fund of $100 per month.

By March 2020, as a result of market price growth, regular contributions, and assuming they had reinvested all their fund income distributions over time, their initial investment would have risen to $48,601. Due the market turmoil at the time, it had dropped from a value of around $66,300 recorded at the end of January 2020.

After ongoing market falls over February and March 2020, they decided to exit the share market and reinvest their proceeds into cash.

Keep in mind that, to stimulate economic growth during COVID, governments around the world had dropped interest rates to record lows.

Had the investor not sold out in March 2020, and if they had continued to make regular $100 monthly contributions and reinvest all their fund income distributions, their investment would have been worth $81,144 by the start of March this year.

That’s a lost financial gain of $32,543, which is equal to missed compound investment growth of around 67 per cent.

Meanwhile, based on the 0.6 per cent annualised return for cash since March 2020, the $48,601 they pulled out of the share market would have increased to just over $53,000. That’s also assuming they continued to make $100 monthly deposits ($3,600 over the three years to March 2023).

Case Study Two

But, returning to the timing the market saying, how would an investor have fared if they had sold out of the Australian share market completely in March 2020 and then reinvested in September 2020 after the Australian share market had rebounded?

The second example is also based on someone who invested $1,000 into the Vanguard Australian Shares Index Fund in January 2000 and then sold at the bottom of the market in March 2020.

They also made regular contributions into the fund of $100 per month, and reinvested all their fund income distributions, so that by late March 2020 their investment had risen to $48,601.

They decided to wait it out through the market volatility at the time and park their money in cash (still depositing $100 in savings per month). As the share market started gaining ground they reinvested their cash back into the same investment fund in September 2020.

But, by being out of the Australian share market for six months, they had already missed out on the market’s 38.5 per cent rebound between late March and September 2020.

If they had not sold out, and simply stayed on their same course, their investment would have grown to $57,383 by September 2020.

But, assuming they did sell in March and then reinvested in September, and they resumed their strategy of regular $100 monthly contributions and reinvesting all fund income distributions, their investment would have grown to $75,248 by the start of March this year.

Compare that with the $81,144 they would have had by staying invested. The foregone gain works out to around $5,900.

The benefits of time in the market

Source: Vanguard. Calculations are based on a $1,000 investment into the Vanguard Australian Share Index Fund from 1 January 2000 to 28 February 2023 with additional $100 monthly contributions and the reinvestment of all income distributions. Total returns are before fees and taxes.

Avoiding the temptation to sell

Choppy markets can cause investors to make rash decisions. And selling activity usually does increase when markets fall.

But, historically, markets have recovered over time. Investors who ignore short-term market volatility, who stay diversified, who invest consistently, and who stay the course, have done exceptionally well over the long term.

Markets will rise and fall, sometimes quite sharply. But for most investors, trying to time when markets will rise or fall is generally a losing strategy.

The smart strategy is to stay invested, leveraging the combination of compounding returns and low investment costs, which together really add up over the long term.

If you have any questions, please get in touch – the team at Apollo is always here to help.

The above material has been reprinted with the permission of Vanguard Investments Australia Ltd