Quarter in review

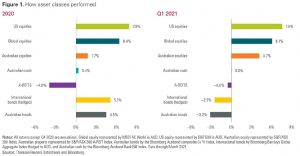

Global investment markets continued to build momentum from the 2020 year over the first quarter of 2021. U.S. Treasury yields rose 86 basis points over the quarter to 1.7%, a level not seen since January 2020, and global equity indices closed 17% above their pre-COVID highs. Within equities, the U.S. market outperformed its peers, coming in at 8% year-to-date compared to the global return of 6%, after the passing of a larger=than-expected USD 1.9 trillion fiscal stimulus package and with the aid of accelerated COVID-19 vaccine rollout program. The Australian share market lagged behind the global market, but nonetheless closed off the quarter 2.5% above its return in 2020 as value stocks recovered and as investors welcomed concerns around a potentially overheated economy and inflation scares.

With vaccinations underway, the number of COVID-19 cases. hospitalisations and deaths in developed economies have been much lower than at the start of the year, paving the way for significant pickup in economic activity in the second half of the year. This is especially the case for countries like the U.S. and U.K., which have accelerated the number of vaccinations over recent months. Closer to home, vaccination progress in Australia and China has proved to be much slower, though the effective containment of the virus to date has meant the pace of economic normalisation is less sensitive to vaccine developments.

Economic and market outlook

Looking ahead, we expect economic normalisation to pick up across the world, particularly in the U.S. and U.K. In the U.S., the passage of the USD 1.9 trillion fiscal stimulus package has led us to upgrade our growth forecast by around 2-2.5 percentage points to a range of 7-7.5% for 2021. Some investors have worried that the size of the U.S. stimulus, combined with the pent-up savings, could lead to an excessive pickup in inflation, and trigger a tightening of policy to an extent that could be damaging for equity markets.

However, despite the upgrade to our growth forecast for this year, we expect the direct effect on inflation of the U.S. government’s recently enacted stimulus package to be relatively modest, at around 7-10 basis points for all of 2021.

In Australia, the economic recovery is well underway thanks to more effective virus containment measures. Mobility indicators for retail and recreational activities, for example, are much closer to their pre-COVID levels than in countries such as the U.K. or Germany. Against this backdrop, we expect output to reach its pre-virus level by the end of the first half of the year, compared to later in 2021/2022 for most of its developed peers.

Global equity markets continued their climb in Q1, navigating a bout of bond market volatility to end at near all-time highs. Despite a repricing of inflation expectations that jostled equities, markets found comfort in the prospects of stronger economic growth, stimulus, and central banks’ expectation for continues easy policy, although tail-risks still remain.

Are rising yields and valuations cause for concern?

Rising yields combines with the strong gain in equities year-to-date contribute to a view on valuations that is broadly more elevated and less attractive than before, despite the support of near-term economic optimism. These movements are reflected in a decline in our 10-year annualised outlook for equities, with Australian and international equities expected to be in the range of 4-6% as of March 2021, modestly downgraded from December 2020.

For some investors, elevated valuations have given reason for pause. As economies recover and return to trend, our equity return outlooks remain guarded and begin to resemble those from 2019 and 2020. Nevertheless, equities as part of a well-diversified portfolio are likely to continue outperforming most other investments and the rate of inflation over the long term.

Once again investors would be well advised to temper their expectations for returns over the coming decade, to ensure portfolios align with their investment objectives, and to focus on the factors within their control. Rebalancing can help to ensure that a portfolio aligns with its intended risk exposure, by responding to relative under and overvaluations within its asset allocation. However, we caution against excessive concentration risk and market timing, where downside risks may be magnified and investment objectives compromised.

On the fixed income front, recent rises in interest rates and inflation risks have left many bond investors jittery. However, a decomposition of fixed income returns suggest that rising rates are actually good news for long-term investors. While most have tended to focus on the price return (which falls as rates rise), many forgot that a bond return consists of two other components – yield distribution and reinvestment income.

Higher rates will not only result in a higher yield distribution, but investors reinvesting these distributions will also be able to reinvest at higher yields, thereby allowing them to benefit from the virtuous cycle of compounding at a higher rate.

If you have any questions or comments, please get in touch – the team at Apollo is always here to help.